Guinea has a population of approximately 14 million people and covers an area of 245,857 sq kms. Its capital city is Conakry.

The economy is largely dependent on agriculture and mineral production. The extractive sector accounts for more than 30% of government revenues, 79% of exports and 18% of the country’s GDP. Guinea is one of the world’s largest producers and exporters of bauxite, has significant iron ore deposits under development (Simandou), and has an established and growing gold industry that is currently home to four producing gold mines.

The Guinean government have actively supported foreign investment into the country and identified the mining industry as a key growth sector. Open and actively seeking to engage with major transnational mining groups for the last 40 years, Guinea is also supported by an established mining code and fiscal regime.

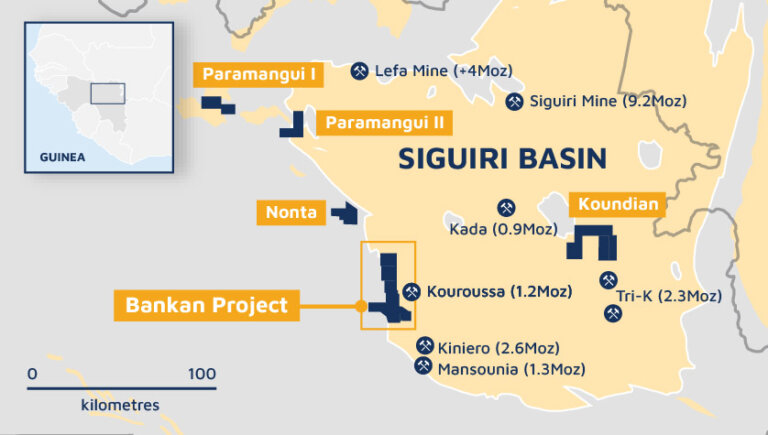

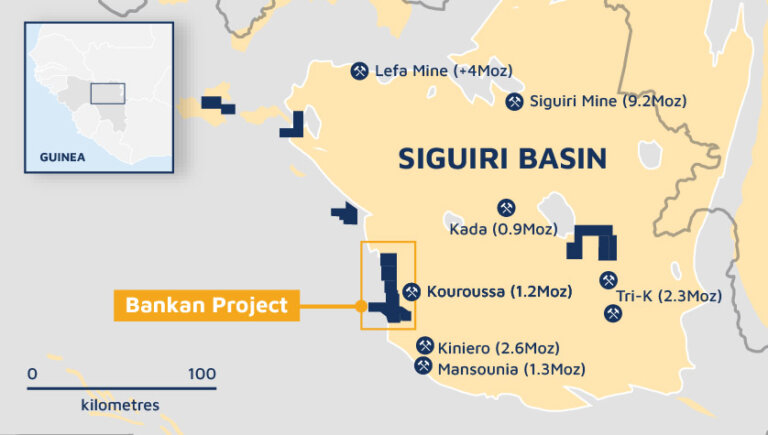

PDI is focused on its Bankan Gold Project, located in the North-East of Guinea. Bankan lies within the Siguiri Basin, which is part of the prolific West African Birimian/Archean gold belts that stretch from Mali, through Guinea, Côte d’Ivoire, Burkina Faso and into Ghana, Guinea’s Siguiri Basin remains the most underexplored region. Significant mines in the region include Siguiri (AngloGold Ashanti), which produced 221,000oz in 2023 and Lefa (NordGold), which produced 163,000oz in 2021. The Kouroussa Gold Mine, owned by Hummingbird Resources achieved first gold pour in June 2023.

The project is 550km by road from Guinea’s capital Conakry within the region of Upper Guinea (Haute-Guinée) and is near the regional administrative centre of Kouroussa. PDI’s Bankan licence area covers 356km2 in four exploration permits: Kaninko, Saman, Bokoro and Argo.

Three permits are held by wholly owned subsidiaries of the Company. The fourth, Argo, is held in a joint venture with the owners of local company Argo Mining SARLU, through which PDI has the right to earn 90% through the exploration phase and acquire 100% at decision-to-mine.

The Company has discovered two key deposits, NEB and BC, which sit only 3kms apart, in the southern section of the licence area and account for all of the 5.38Moz Mineral Resource estimate. PDI believes the NEB and BC deposits are only the beginning of the discovery journey and there is the opportunity to unearth other similar deposits within its larger licence area.

The Bankan Project is moving rapidly towards the development phase, with an Environmental & Social Impact Assessment (ESIA) and a Pre-Feasibility Study (PFS) completed in April 2024. The PFS outlined a maiden Ore Reserve estimate of 3.05Moz, average production of 269Koz per annum over a 12-year mine life, and strong financial metrics.

Bankan PFS highlights

NEB & BC deposits

NEB is the main discovery within the Bankan Gold Project licence area and BC is a satellite discovery 3km to the

west of NEB. These two deposits combined make up the current Mineral Resource estimate of 100.5Mt @ 1.66g/t for

5.38Moz of gold (including 4.14Moz Indicated), positioning the Bankan Project as the largest gold discovery in

West

Africa in more than a decade.

The current NEB estimate includes an Open Pit Mineral Resource reported at a 0.5g/t cut-off grade within a US$1,800/oz optimised resource pit shell, which totals 81.4Mt @ 1.53g/t for 3.99Moz of gold. A high-grade Underground Mineral Resource reported at a 2.0g/t cut-off is present below the resource pit shell, which totals 6.8Mt @ 4.07g/t for 896Koz of gold (Inferred).

There is potential to grow the NEB Open Pit Mineral Resource through targeted drilling of additional high-grade shoots within the resource pit shell, and at the Gbengbeden resource pit shell immediately north of the main NEB deposit. The NEB Underground Mineral Resource is open at depth. There is also potential to incrementally expand the current underground resource along strike to the south, and for additional underground mineralisation in footwall structures.

The BC Mineral Resource is reported at a 0.4g/t Au cut-off grade within a US$1,800/oz optimised resource pit shell, totalling 12.2Mt @ 1.24g/t for 487Koz of gold and includes 50%, or 244Koz, in the Indicated category. The BC deposit remains open down plunge to the south-west, and along strike to the south.

Initial metallurgical test work has indicated that gold mineralisation within the Bankan Project deposits is free-milling with high gold recoveries and amenable to a simple, industry-standard CIL processing with upfront gravity recovery.

Pre-Feasibility Study

PDI completed a PFS in April 2024 to assess the technical and financial viability of developing and operating a

gold

mine at the Bankan Project, which was the first such study completed for the Project.

The PFS envisages the development of open pit mines at the NEB and BC deposits, an underground mine at NEB, a 5.5 Mtpa conventional CIL processing plant, a dry-stacked tailings storage facility and various supporting facilities and infrastructure.

Two cases and associated mine schedules were developed for the PFS:

Key project and financial metrics for the PFS cases are shown below:

The Extension Case, which is PDI’s preferred case, produces an average of 269koz per annum over 12 years (total production of 3.23Moz), from mill feed of 61.5Mt @ 1.77g/t containing 3.49Moz of gold.

Open pit mining of the NEB and BC deposits will employ a conventional drill, blast, truck and shovel operation. Mining of the NEB underground orebody will be via transverse long hole open stoping with paste fill.

The 5.5Mtpa processing plant will utilise conventional CIL technology with upfront gravity recovery. Conservative PFS recovery assumptions of 92.6% for NEB and 89.5% for BC have been adopted.

NEB mine design

Bankan Project process flowsheet

A two-year construction period will commence with initial site earthworks, construction of key enabling infrastructure and establishment of NEB underground mine access, allowing underground ore to be delivered to the processing plant for the start of operations.

Establishment, mining and stockpiling of the BC deposit will commence ~6 months prior to first production, with BC ore to also form part of initial ore feed. BC will be mined in just over one year. The NEB open pit will be mined in two stages to bring forward access to high-grade ore within the middle section of the pit. The Gbengbeden satellite deposit will be mined in one year during year 6. In the Extension Case, the NEB underground operation will mine Ore Reserves in years 1-6 and in year 12 (crown pillar). Inferred Mineral Resources will be mined in years 6-11 and comprise 12.8% of total contained gold.

Bankan Project site layout

The Extension Case delivers a post-tax NPV5% of US$668m (A$1.0bn) and IRR of 25.4% at a conservative PFS gold price assumption of US$1,800/oz. The post-tax payback period is 3.5 years. There is significant upside at high gold prices, with the post-tax NPV5% increases to US$1.4bn (A$2.1bn), IRR increasing to 41.7% and payback period reducing to 2.0 years at a gold price of US$2,300/oz.

The PFS capital cost estimate of US$456m includes establishment of all required infrastructure, pre-production operating costs, indirect costs and US$43m contingency. All-in sustaining costs (AISC) of ~US$1,130/oz are based on robust and conservative assumptions, delivering high profit margins.

Based on the positive PFS, the Board has endorsed PDI proceeding to a Definitive Feasibility Study (DFS). Multiple opportunities were also identified in the PFS which have potential to significantly improve the technical and financial outcomes reported in the PFS, and these will be pursued in the DFS.

Key optimizations and further works

Ore Reserve estimate

A maiden Ore Reserve estimate was prepared as part of the PFS, which totals 57.7Mt @ 1.64g/t for 3.05Moz of

gold.

This, represents 74% conversion of Indicated Mineral Resources into Probable Ore Reserves.

ESIA

The NEB and BC deposits sit in the Peripheral Zone of the Upper Niger National Park, approximately 21km and 18km

away from the Core Conservation Zone. PDI is undertaking an extensive ESG program with the support of globally

recognised external consultants to establish a baseline understanding of the regional environment and develop

plans to sustainably manage potential future mining operations.

The ESIA for the Bankan Project was completed in April 2024 following more than two years of environmental and social work, including baseline surveys and studies, community liaison, and government and stakeholder engagement. No fatal flaws were identified in the ESIA and development of the required management frameworks and management plans is well advanced. The PFS design also included substantial embedded design mitigants, including: fully-lined dry-stack tailings storage facility and detoxification of tailings; minimum 500m standoff from the Niger River and exclusion zones along other tributaries; and location of the hybrid power generation facilities (thermal/solar/battery) and accommodation village outside the Upper Niger National Park’s Peripheral Zone boundary.

The ESIA and the PFS are key documents in the permitting process for the Project, and PDI is aiming to secure an Exploitation Permit in late 2024.

Numerous near-surface prospects have been identified within 3kms of the NEB and BC deposits from previous aircore and auger drilling. Further drilling is underway to progressively test the potential for these prospects to host economic gold mineralisation to further extend Bankan’s current 12-year LOM. Encouraging results have been received from multiple targets, with excellent potential for new satellite deposits to be defined which can support an operation centred around the NEB and BC deposits.

NEB and BC are two of potentially many gold accumulations which occur within PDI’s 356km2 of permits. To date, PDI has used both geophysical and auger drilling programs to delineate additional high-quality regional targets. A dedicated regional exploration team is focused on advancing the regional exploration element of the growth strategy, with a current focus on the Argo permit area.

The Argo area is located 15-20km north of NEB along the major gold structural corridor that represents the western margin of the Siguiri Basin. It contains numerous active and inactive artisanal gold workings. Argo has excellent potential to host significant gold deposits and multiple targets have been defined which mainly occur along three anomalous auger trends.

Drilling at Argo commenced in mid-2023, and several drill programs have been completed to date. Excellent results have been received from multiple targets, particularly at the Fouwagbe and Sounsoun targets which have advanced to the resource definition drilling phase.

Regional exploration will continue at Argo and is also moving into other parts of the Bankan permits, such as the Bokoro South area.

The Koundian Project is located approximately 115km east-northeast of the Company’s 5.38Moz Bankan Gold Project, also within the Birimian-age Siguiri Basin.

The Koundian Project contains widespread gold. Results from 63 holes, totalling 2,854m, were released via the ASX on 19 May 2022 with the drilling carried out on a series of traverses testing potentially well mineralised structures including two areas of extensive shallow artisanal gold workings.